LHCREs and their impact

Is it just NPfIT all over again?

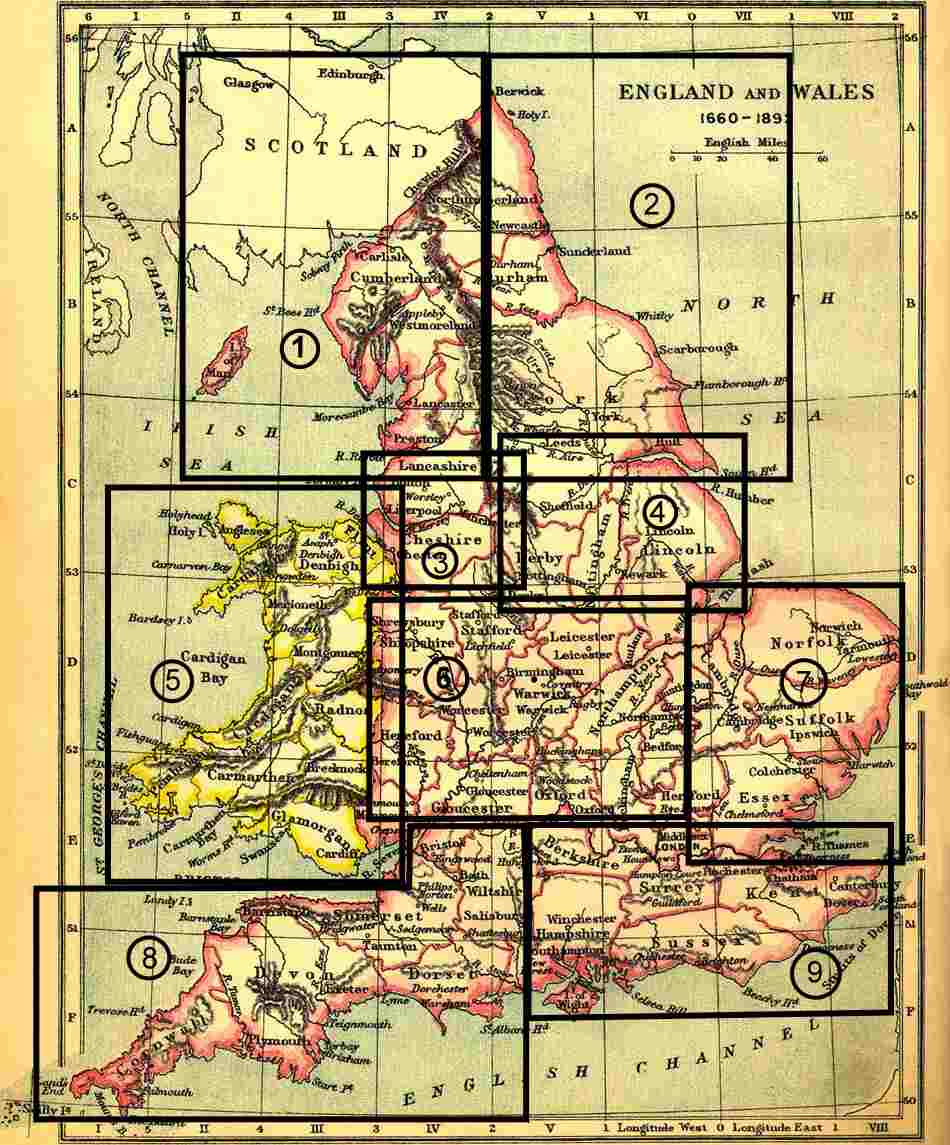

This is England

The LHCREs are an NHS England initiative, they do not directly affect Scotland, Wales and Northern Ireland. However, the Interoperability standards used in England will inevitably need to be understood (and used in transfers of care) outside of England

First off, let me say not it is not just the National programme all over again. But there are some elements that are the same, and those aspects are mostly commercial in nature. The technical aspirations of the LHCREs seems less shackled, but more on that later.

What Are LHCREs?

Local Healthcare and Care Record Exemplars are the latest incarnation for NHS England's exemplar programme - identifying trail blazing regions to push ahead with regional healthcare records. They have grown out of the work of various existing Global Digital Exemplars (GDEs) in the light of government initiatives to think regionally about healthcare, for example through the work of the regional Sustainability and Transformation Plan organisations (STPs) instatiated across the UK in 2017.

It's surprisingly difficult to find a succinct overview of the interplay of all of these organisations, and from the work I have encountered in each region I would say it is not the same everywhere. Here are a few links to help;

In overview, the concept of the LHCREs is to free up patient data to support Health and Social Care on a regional basis using Information Systems and Technology. This support is imagined in two ways; through providing a transversal record that will support health and social care workers in providing care for patients and citizens and also to provide records that can be analysed and used in support of population health management.

LHCRES and their Business Models

The aims of the LHCREs do see to align with the original aims of the previous National Programme, but this time with a much stronger emphasis population health and the longitudinal record. The business model is different however. Instead of appointing companies to be Local Service Providers, the LHCREs are being pump primed with some cash, and sent to do their own procurements based on some directives from NHS England with respect to the specifications. Helpfully NHS England has put in place a purchasing Framework through which the monay can be channelled - though interestingly, not all LHCREs are using this Framework: some have chosen other procurement routes.

Technical Approaches

NHS England has stipulated that all LHCREs must use the NHS CareConnect and GPConnect APIs (in due course), and must connect to the national services, such as the National Record Locator. LHCREs must also build a longitudinal set of patient records on which to build population health management.

Depending on the region and the individual LHCRE involved, you can find several different flavours or emphases in the way they plan to implement their Regional Records.

- There is the approach that is to first build a Portal overarching existing applications, then build out a new architecture underneath this to underpin the population health requirements.

- An approach to connect all Primary Care then link to Secondary Care and build out data repositories underneath this.

- An approach that integrates existing systems and places a population health or longitudinal record over the top

- Then there is the the Healthcare Interoperability Exchange (Network) approach, linking existing systems and allowing access by a population health tool to the information federated by the HIE. Actually, it transpires that nearly all the LHCREs include IHE as a significant part of their architectures.

- There is the 'one large data repository' approach, aggregating information together

While there is a lot of variation, this is not surprising as each region comes from a different starting position - and each region also has different leadership, whether that be an existing GDE, or grouping of GDEs, or a new organisation set in place for the LHCRE.

What will be the Effects of the LHCREs

Already, ironically, the LHCREs have put slowed the market for Interoperability. For the last 18 months NHS England has been talking about this conceptually and putting it in place. It has meant a reluctance for local healthcare providers to invest in local Interoperability projects (with a few notable exceptions).

So what next? Currently the LHCRE providers are being chosen as LHCREs and Suppliers rush towards the supply of cash to pump prime thes projects. Inevitably there will be a bit of over-reach from suppliers, but in general, the emphasis NHS England has placed on its FHIR based standards should open up the market for multiple players and a lot of innovation. In a way - while the NHS LHCRE (and other) purchasing frameworks favour large suppliers, this should push the costly transformational business out to larger providers, while leaving a relatively open information platform on which smaller providers/SMEs should be able to build interesting and innovative applications. There are two important remaining impediments to large scale involvement of SMEs

- Patient Privacy and Consent is tricky to navigate with the NHS's current FHIR interfaces and plans. Technically they are not enough in themselves and caution about access to patient data will (rightly) place a barrier on market entry.

- Lots of small applications, each having a small effect, will not give a coordinated improvement in healthcare (and so it will be hard to see the true value of individual applications). This could make the winners and losers look more like a lottery than anything planned.

But there are ways through this, and in fact being aware of these impediments will help business plan to be effective. Careful thought and careful planning can lead to some interesting developments in the UK.